Multiple Choice

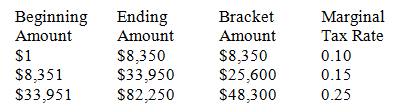

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The maximum dollar amount of income taxes in the $33,951-$82,250 "bracket" paid by a single filer with taxable income of $77,100 would be:

A) $150

B) $835

C) $3,840

D) $4,675

E) $12,075

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Professional corporations (PCs)and service corporations (SCs)are corporate

Q28: The average tax rate for a corporation

Q31: Which form of business organization typically offers

Q33: Which of the following business organizational forms

Q34: The rules and procedures established to govern

Q35: Following is a partial 2009 personal income

Q38: A trademark must be novel in order

Q43: In a general partnership,legal action that treats

Q53: Which of the following is not a

Q79: A limited partnership limits certain partners' liabilities