Multiple Choice

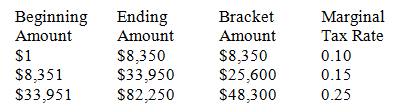

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The average tax rate for a single filer with taxable income of $33,950 would be:

A) 10.0%

B) 13.8%

C) 15.0%

D) 16.7%

E) 20.0%

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The income received by a proprietorship is

Q17: Certification marks are typically used to:<br>A) indicate

Q26: Business angels typically initiate their investments during

Q35: Intellectual property can be protected by all

Q39: Patents that cover most inventions pertaining to

Q54: During the development stage,seed financing chiefly comprises:<br>A)funds

Q57: Intellectual property rights to "writings" in written

Q57: Business method patents protect a specific way

Q65: Following is a partial 2009 corporate income

Q92: A work does not need to be