Multiple Choice

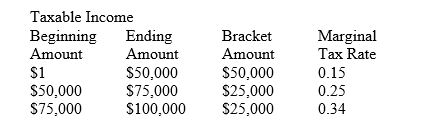

Following is a partial 2012 corporate income tax schedule:

-The cumulative dollar amount of income taxes paid by a corporation with taxable income of $75,000 would be:

A) $6,250

B) $7,500

C) $8,500

D) $13,750

E) $22,250

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Based on 2012 tax schedules,the highest marginal

Q34: The rules and procedures established to govern

Q41: Certification marks provide indications of quality.

Q53: Which of the following are intellectual property

Q57: Business method patents protect a specific way

Q64: The average tax rate for a corporation

Q64: Trademarks are intellectual property rights that allow

Q85: Certification marks cover memberships in groups (e.g.,

Q87: The term that refers only to words,

Q93: Most trademarks take the form of names,