Multiple Choice

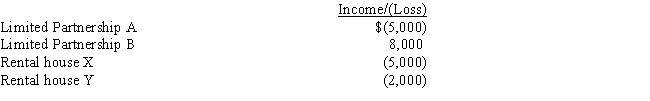

Judy and Larry are married and their combined salaries for the current year are $115,000.They actively participate in the rental of two houses.For the current year they have the following losses:

What is Judy and Larry's adjusted gross income?

A) $108,000

B) $111,000

C) $114,000

D) $115,000

E) $118,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Georgia sells stock she purchased for $20,000

Q31: Which of the following losses are generally

Q40: Nancy is the owner of an apartment

Q54: The term tax shelter refers to investment

Q85: Nelson is the owner of an apartment

Q86: The Ottomans own a winter cabin in

Q111: For each of the following situations, determine

Q121: Which of the following losses are generally

Q125: Jerome owns a farm,which has three separate

Q129: Any corporate capital loss not used in