Short Answer

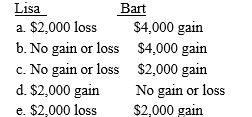

Lisa sells some stock she purchased several years ago for $10,000 to her brother Bart for $8,000.One year later Bart sells the stock for $12,000.The tax consequences to Lisa and Bart are:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: During the year, Daniel sells both of

Q32: For each of the following situations, determine

Q48: Aunt Bea sold some stock she purchased

Q56: Match each statement with the correct term

Q62: Ford's automobile that he uses 100% for

Q65: Material participation requires that an individual participates

Q86: Carmen purchased a business for $150,000 by

Q101: During the current year, Terry has a

Q109: Match each statement with the correct term

Q114: Tim owns 3 passive investments.During the current