Essay

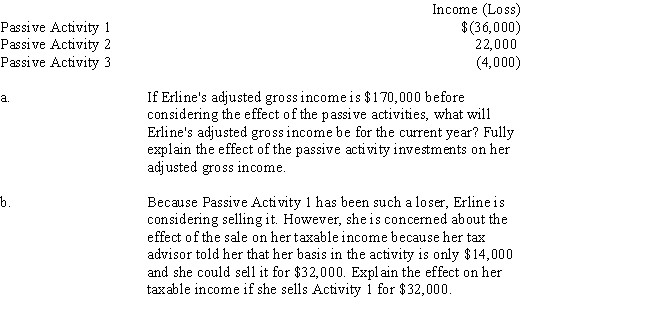

Erline begins investing in various activities during the current year.Unfortunately,her tax advisor fails to warn her about the passive loss rules.The results of the three passive activities she purchased for the current year are:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Match each statement with the correct term

Q17: "Active participation" and "real estate professional" are

Q30: Fowler sells stock he had purchased for

Q38: Match each statement with the correct term

Q50: While most rental activities are classified as

Q53: Barry owns all of the stock of

Q63: Why do the wash sale rules apply

Q82: Willie sells the following assets and realizes

Q107: Darien owns a passive activity that has

Q119: Travis is a 30% owner of 3