Short Answer

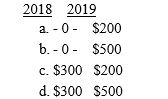

Dustin buys 200 shares of Monroe Corporation common stock on December 1,2015,for $2,000.He buys an additional 200 shares for $1,800 on December 23,2016.On December 28,2016,Dustin sells the first 200 shares for $1,700.He sells the last 200 for $1,600 on June 15,2017.What is (are)the amount(s)and the year of recognition of losses that Dustin can recognize?

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The general rule for determining the basis

Q20: Dana purchases an automobile for personal use

Q45: Match each statement with the correct term

Q76: Sara constructs a small storage shed for

Q79: On June 10,2015,Wilhelm receives a gift of

Q81: Larry gives Linda 300 shares of stock

Q81: On June 10,2015,Akira receives a gift of

Q82: Sarah purchased a diamond bracelet for $3,000

Q83: Pedro purchased all of the stock of

Q103: Terri owns 1,000 shares of Borneo Corporation