Multiple Choice

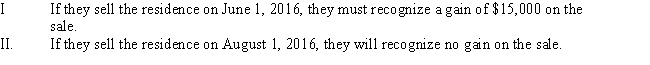

Charlotte purchases a residence for $105,000 on April 13,2004.On July 1,2014,she marries Howard and they use Charlotte's house as their principal residence.If they sell their home for $390,000,incurring $20,000 of selling expenses and purchase another residence costing $350,000.Which of the following statements is/are correct concerning the sale of their personal residence?

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following qualifies as a

Q11: Match each statement with the correct term

Q33: Which of the following qualify as a

Q43: Which of the following qualifies as a

Q49: Lindsey exchanges investment real estate parcels with

Q54: The deferral of a gain realized on

Q58: The basis of replacement property in a

Q101: An involuntary conversion occurs whenever a loss

Q104: Which of the following qualify as a

Q116: Nancy acquired office equipment for her business