Short Answer

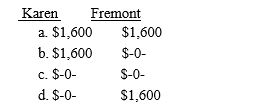

Karen receives the right to acquire 400 shares of Fremont Corporation stock through the company's incentive stock option plan.The fair market value of the stock at the date of the grant is $15 and the exercise price of the option is $19 per share.The fair market value of the stock at the date of exercise is $22.At the date of exercise,the tax consequences to Karen and the Fremont Corporation are

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Dunn Company bought an old building in

Q16: For the current year, Salvador's regular tax

Q30: Which of the following is (are)AMT tax

Q37: Cary is an employee with the Bayview

Q47: Unmarried taxpayers who are not active participants

Q48: When calculating AMTI, individual taxpayers must add

Q66: Which of the following itemized deductions is

Q90: On September 15,2016,Spiral Corporation grants Jay an

Q91: Karl is scheduled to receive an annuity

Q95: Tim has a 25% interest in Hill