Essay

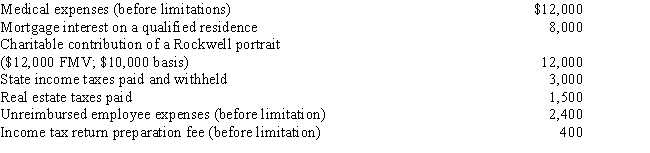

Eileen is a single individual with no dependents.Her adjusted gross income for 2016 is $60,000.She has the following items that qualify as itemized deductions.What is the amount of Eileen's AMT adjustment for itemized deductions for 2016?

Correct Answer:

Verified

Eileen must add back $6,100 of her itemi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Grand Corporation has $100,000 of U.S.source taxable

Q15: Ortiz Corporation determined its AMTI to be

Q19: Harriet is an employee of Castiron Inc.and

Q23: The Data Company employs John and Jesse.John

Q36: Abraham establishes a Roth IRA at age

Q37: Any structure over 100 years old is

Q50: Thelma can get the 10% penalty on

Q59: Sonya is an employee of Gardner Technology

Q75: The employee's contribution to a nonqualified pension

Q86: Nestor receives the right to acquire 1,000