Essay

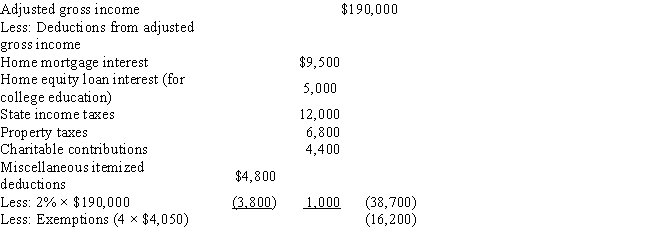

Rodrigo and Raquel are married with 2 dependent children,age 18 and 20,and reported the following items on their 2016 tax return:

Determine Rodrigo and Raquel's regular tax liability and,if applicable,the amount of their alternative minimum tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A Keogh plan is a type of

Q9: Savings incentive match plan for employees (SIMPLE)

Q31: Pension plans are subject to excess contribution

Q58: Match each statement with the correct term

Q59: A U.S.formed multinational corporation<br>I.Can avoid the payment

Q69: Peter opened his IRA in 2003 and

Q71: Posie is an employee of Geiger Technology

Q72: Concerning individual retirement accounts (IRAs),<br>I.A single taxpayer

Q73: Hillside Group,a partnership,purchased a building for $60,000

Q79: Gilberto is a Spanish citizen living in