Essay

Consider the following:

?

?

Case Income (loss) for quarters 1 through 4 is , and , respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be . No carryback benefit exists, and any future annual benefit is uncertain.

Case B Assume the same facts as in Case A. However, at the end of quarters 1 through 3 , annual income is estimated to be .

Case C Quarterly income (loss) levels were , ( , and . A yearly operating loss of was anticipated throughout the year. Frior years' income of is avail able for carryback. The same tax rates were relevant to the carryback period Required:

?

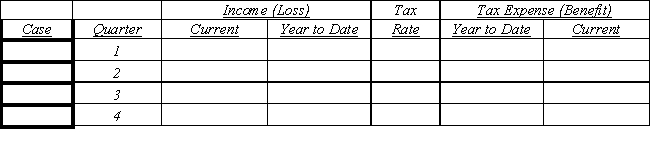

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

?

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Adam Enterprise includes seven industry segments.Operating

Q17: For purposes of interim reporting, US-GAAP permits

Q18: Non-ordinary items resulting in income or loss<br>A)include

Q19: Which of the following statements about interim

Q20: The incremental income tax effect utilized to

Q22: A corporation made up of an automobile

Q23: The management of Trident, Inc.is trying to

Q24: Abbott Inc.began the year with 750 units

Q25: Cammy Company had inventory at the end

Q26: Which of the following is not required