Essay

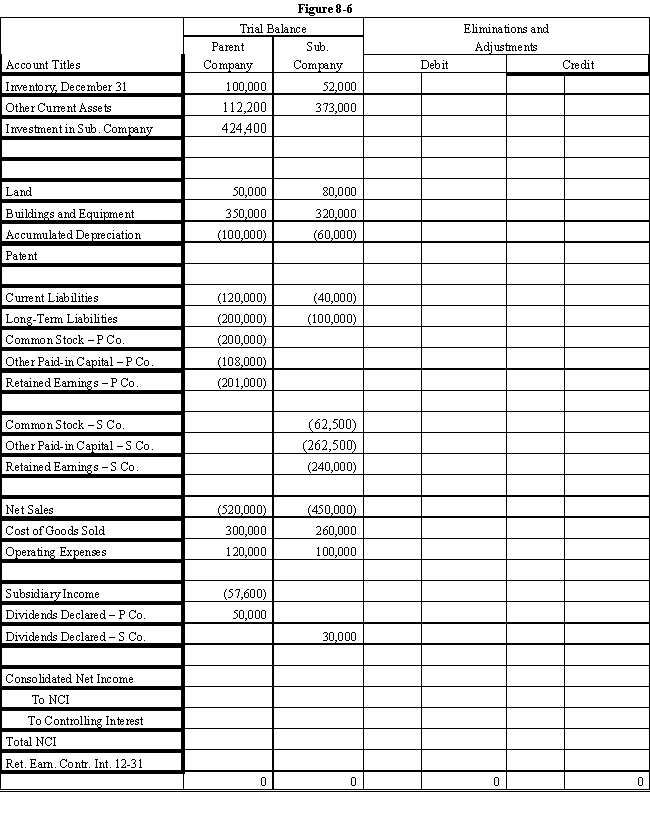

On January 1, 2016, Parent Company purchased 8,000 shares of the common stock of Subsidiary Company for $350,000.On this date, Subsidiary had 20,000 shares of $5 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $150,000 and $200,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.Parent Company uses the simple equity method to account for its investment in Sub.

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,500 shares of common stock to non-controlling shareholders for $50 per share.

?

In the last quarter of 2017, Subsidiary Company sold goods to Parent Company for $40,000.Subsidiary's usual gross profit on intercompany sales is 40%.On December 31, $7,500 of these goods are still in Parent's ending inventory.

?

Required:

?

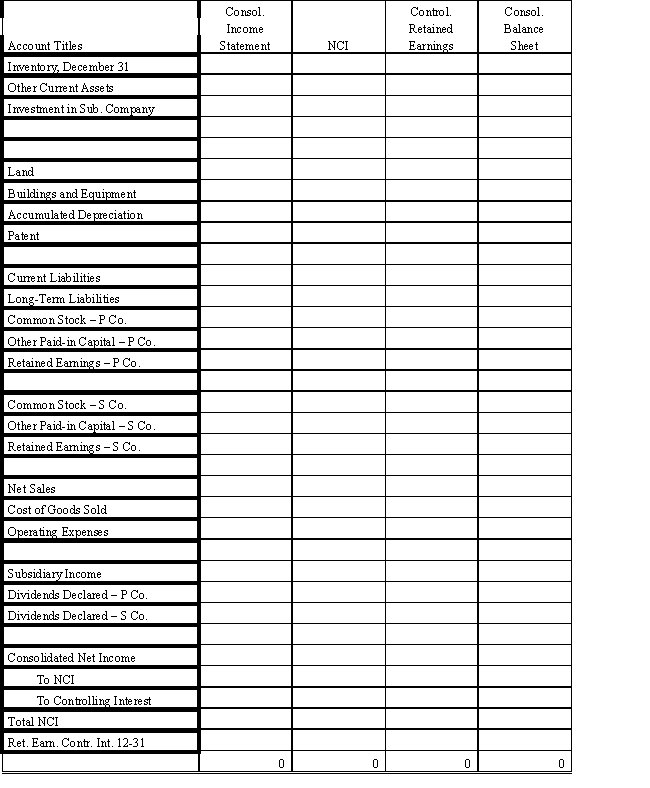

Complete the Figure 8-6 worksheet for consolidated financial statements for 2017.

?

?

Correct Answer:

Verified

Answer 8-6.

?

?

?

?

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: On January 1, 2016, Paris Ltd.paid

Q32: Which of the following situations is viewed

Q33: Able Company owns an 80% interest

Q34: On January 1, 2016, Parent Company purchased

Q35: On January 1, 2016, Prism Company

Q37: When the parent purchases some newly issued

Q38: A parent company owns a 100% interest

Q39: Able Company owns an 80% interest in

Q40: When a parent purchases a portion of

Q41: When a parent purchases a portion of