Essay

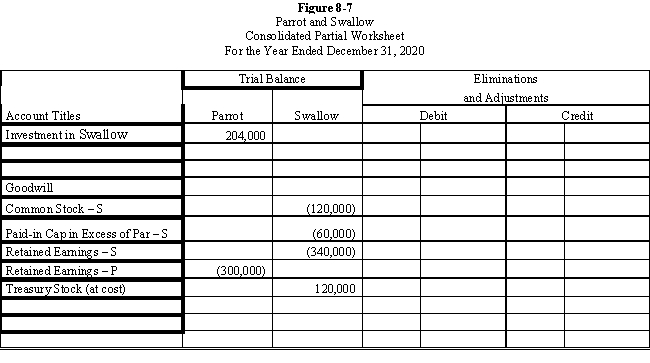

Parrot, Inc.purchased a 60% interest in Swallow Company on January 1, 2016, for $204,000.Any excess of cost was attributable to goodwill.

?

On January 1, 2019, Swallow purchased 2,400 of its shares held by non-controlling stockholders for $50 per share.Swallow equity balances on various dates were as follows:

?

?

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

?

Required:

?

Prepare the necessary determination and distribution of excess schedules and all Figure 8-7 worksheet eliminations and adjustments on the following partial worksheet prepared on December 31, 2020:

?

?

Correct Answer:

Verified

Answer 8-7.

?

?

Eliminations and Adjus...

Eliminations and Adjus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: On January 1, 2016, Parent Company purchased

Q7: Manke Company owns a 90% interest in

Q8: Apple Inc.purchased a 70% interest in

Q9: Pepper Company owned 60,000 of Salt

Q10: Consolidated statements for X, Y, and Z

Q12: When a subsidiary issues a stock dividend,

Q13: Pepper Company owned 60,000 of Salt

Q14: When a subsidiary owns shares of the

Q15: a.What would be Company P's investment balance

Q16: On January 1, 2016, Parent Company