Essay

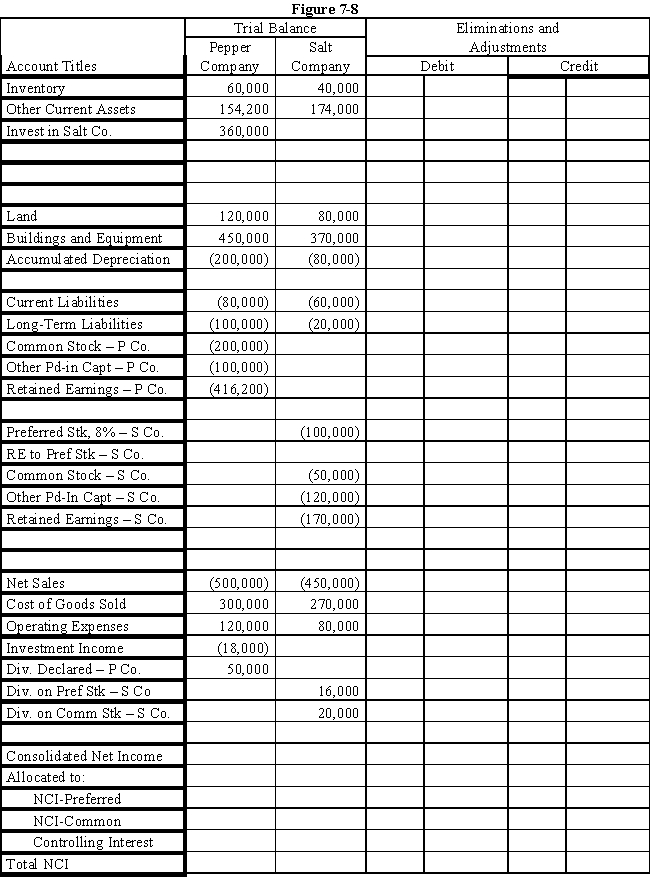

On January 1, 2016, Pepper Company purchased 90% of the common stock of Salt Company for $360,000 when Salt had total shareholders' equity as follows:

?

?

Any excess of cost over book value on this date is attributed to a patent, to be amortized over 10 years.The 8% preferred stock is cumulative, non-participating, and has a liquidating value of par plus dividends in arrears.There were no preferred dividends in arrears on January 1, 2016.Pepper elected to account for its investment in Salt using the cost method.

?

During 2016, Salt had a net loss of $10,000 and paid no dividends.In 2017, Salt had net income of $100,000 and paid dividends totaling $36,000.

?

During 2017, Salt sold merchandise to Pepper for $40,000, of which $20,000 is still held by Pepper on December 31, 2017.Salt's usual gross profit is 40%.

?

Required:

?

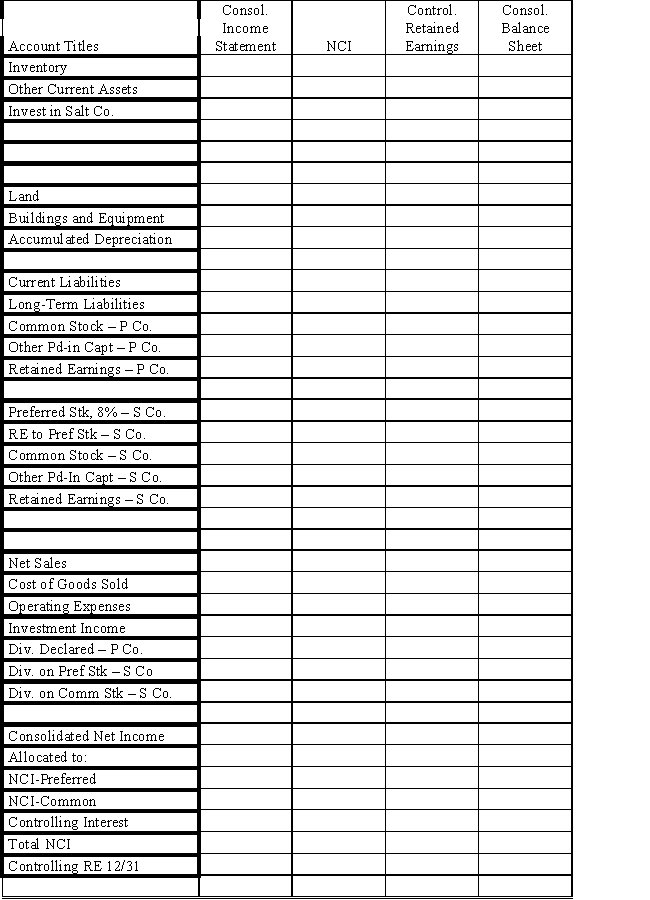

Complete the Figure 7-8 worksheet for consolidated financial statements for the year ended December 31, 2017.

?

?

?

Correct Answer:

Verified

Answer 7-8.

?

?

?

?

Eliminations and A...

Eliminations and A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: On January 1, 2016, Patrick Company

Q14: In the year a parent sells its

Q15: On January 1, 2016, Parent Company

Q16: Which of the following is not true

Q17: Company P Industries purchased a 70% interest

Q19: Pepin Company owns 75% of Savin Corp.Savin's

Q20: When a parent sells its subsidiary

Q21: Partridge purchased a 60% interest in

Q22: Pine Company purchased a 60% interest in

Q23: It is common for a parent