Essay

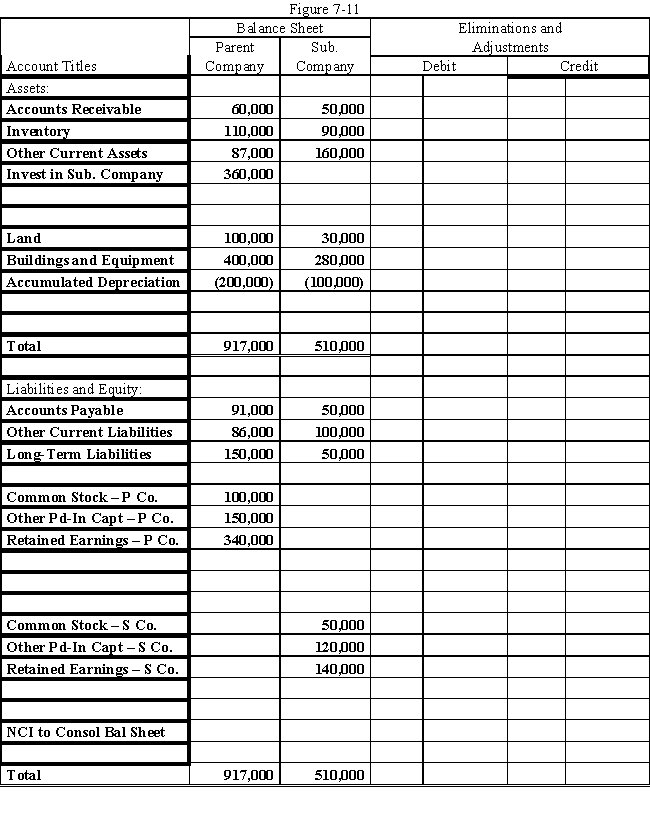

On January 1, 2016, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000.On this date, Subsidiary had total owners' equity of $270,000, including retained earnings of $100,000.

?

On January 1, 2016, any excess of cost over book value is attributable to the undervaluation of land, building, and goodwill.Land is worth $20,000 more than cost.Building is worth $60,000 more than book value.It has a remaining useful life of 6 years and is depreciated using the straight-line method.

?

During 2016, Parent has accounted for its investment in Subsidiary using the cost method.

?

During 2016, Subsidiary sold merchandise to Parent for $70,000, of which $20,000 is held by Parent on December 31, 2016.Subsidiary's usual gross profit on affiliated sales is 50%.

?

On December 31, 2016, Parent still owes Subsidiary $5,000 for merchandise acquired in December.

?

On July 1, 2016, Parent sold to Subsidiary some equipment with a cost of $40,000 and a book value of $18,000.The sales price was $30,000.Subsidiary is depreciating the equipment over a 4-year life, assuming no salvage value and using the straight-line method.

?

Required:

?

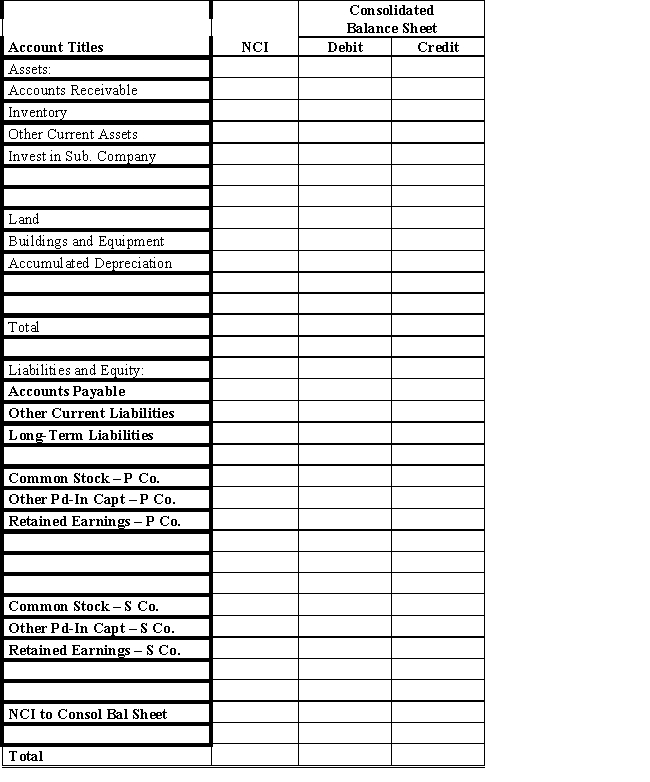

Prepare a determination and distribution of excess schedule.Next, complete the Figure 7-11 worksheet for a consolidated balance sheet as of December 31, 2016.

?

Correct Answer:

Verified

Answer 7-11.

?

?

?

?

Eliminations and ...

Eliminations and ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Pepin Company owns 75% of Savin Corp.Savin's

Q20: When a parent sells its subsidiary

Q21: Partridge purchased a 60% interest in

Q22: Pine Company purchased a 60% interest in

Q23: It is common for a parent

Q25: A parent company owns a 90% interest

Q26: When selling an investment in a subsidiary,

Q27: Page Company purchased an 80% interest

Q28: On January 1, 2016, Patrick Company

Q29: Pine Company purchased a 60% interest in