Essay

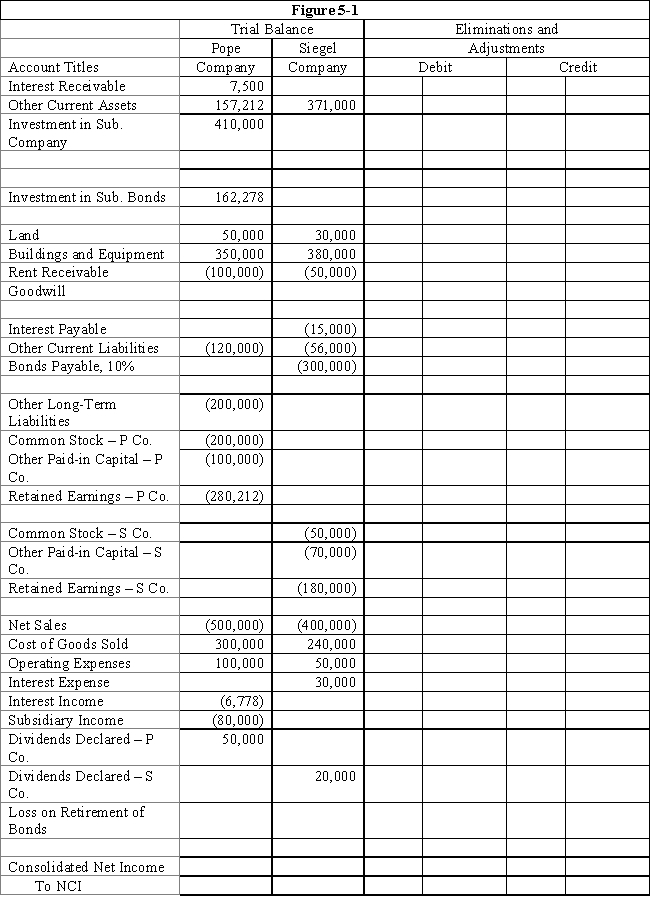

On January 1, 2016, Pope Company acquired 100% of the common stock of Siegel Company for $300,000.On this date Siegel had total owners' equity of $250,000.Any excess of cost over book value is attributable to goodwill.Pope accounts for its investment in Siegel using the simple equity method.

?

On July 1, 2016, Siegel Company sold to outside investors $300,000 par value of 10-year, 10% bonds.The price received was equal to par.The bonds pay interest semi-annually on July 1 and January 1.

?

During early 2019, market interest rates on bonds similar to those issued by Siegel decreased to 8%.As a result, the market value of the bonds increased.On July 1, 2019, Pope purchased $150,000 par value of Siegel's bonds, paying $163,000.Pope still holds the bonds on December 31, 2019 and has amortized the premium, using the straight-line method.

?

Required:

?

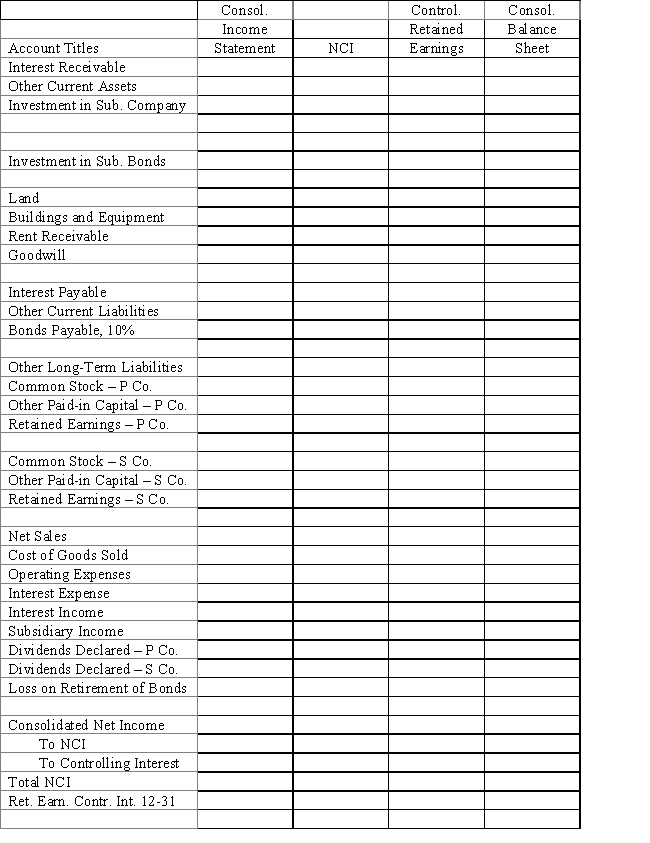

Complete the Figure 5-1 worksheet for consolidated financial statements for the year ended December 31, 2019.Round all computations to the nearest dollar.

?

?

?

?

Correct Answer:

Verified

Eliminations and Adjustments:

(CY)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Eliminations and Adjustments:

(CY)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Soap Company issued $200,000 of 8%, 5-year

Q37: The motivation of a parent company to

Q38: Company P owns 80% of Company S.On

Q39: Elimination procedures for intercompany bonds purchased from

Q40: A subsidiary has outstanding $100,000 of 8%

Q42: To eliminate intercompany bonds and interest expense

Q43: Leasing subsidiaries are formed to achieve centralized

Q44: In years subsequent to the year one

Q45: When one member of a consolidated group

Q46: The purchase of outstanding subsidiary bonds by