Essay

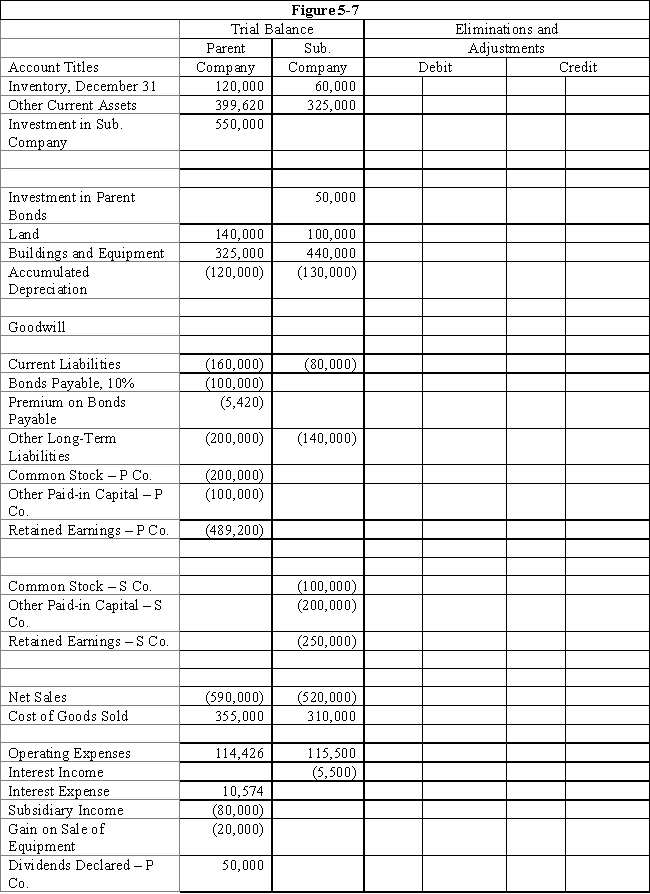

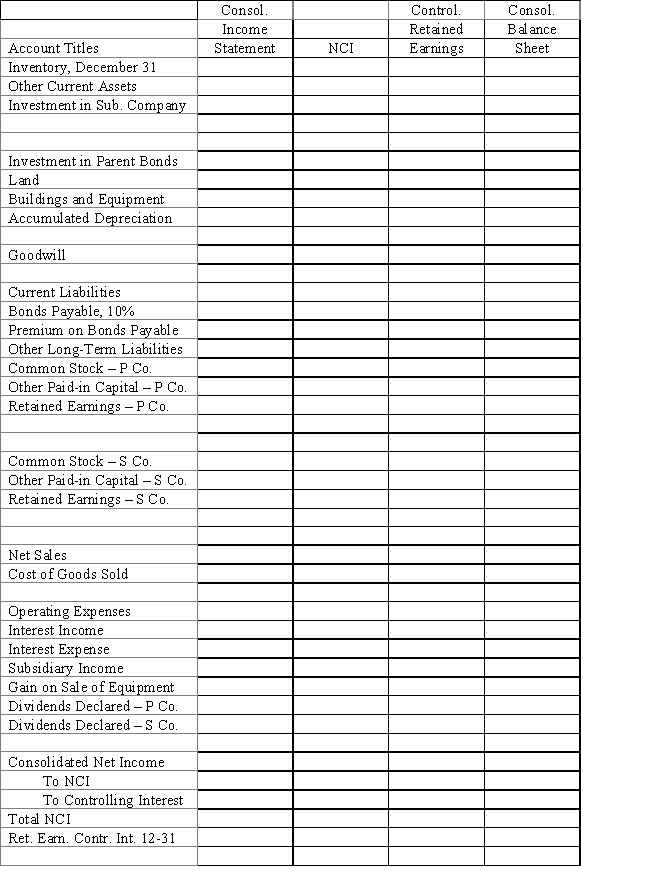

On January 1, 2016, Parent Company purchased 80% of the common stock of Subsidiary Company for $402,000.On this date Subsidiary had total owners' equity of $440,000.Any excess of cost over book value is due to goodwill.Parent accounts for its investment in Subsidiary using the simple equity method.

?

On January 1, 2016, Parent held merchandise acquired from Subsidiary for $50,000.During 2016, Subsidiary sold merchandise to Parent for $120,000, of which Parent holds $30,000 on December 31, 2016.Subsidiary's gross profit on sales is 40%.On December 31, 2016, Parent still owes Subsidiary $5,000 for merchandise.

?

On December 31, 2016, Parent sold $100,000 par value of 11%, 10-year bonds for $106,232, which resulted in an effective interest rate of 10%.The bonds pay interest semi-annually on June 30 and December 31.Parent uses the effective-interest method of amortization for the premium.

?

An amortization table for 2017 and 2016 is presented below:

?

?

On December 31, 2017, Subsidiary repurchased $50,000 par value of the bonds, paying a price equal to par.The bonds are still held on December 31, 2016.

?

On December 31, 2016, Parent sold equipment with a cost of $50,000 and accumulated depreciation of $30,000 to Subsidiary for $40,000.Subsidiary will use the equipment beginning in 2019.

?

Required:

?

Complete the Figure 5-7 worksheet for consolidated financial statements for the year ended December 31, 2016.Round all computations to the nearest dollar.

?

Correct Answer:

Verified

Answer 5-7.

?

?

?

?

Determination and ...

Determination and ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Soap Company issued $200,000 of 8%, 5-year

Q10: Under a sales-type lease between affiliated companies,

Q11: On January 1, 2019, Parent Company purchased

Q12: Powell Company owns an 80% interest in

Q13: Powell Company owns an 80% interest in

Q15: Which of the following statements is true?<br>A)No

Q16: The usual impetus for transactions that create

Q17: The parent company leased a machine

Q18: On January 1, 2016 Parent Company acquired

Q19: On January 1, 2016, Pope Company acquired