Essay

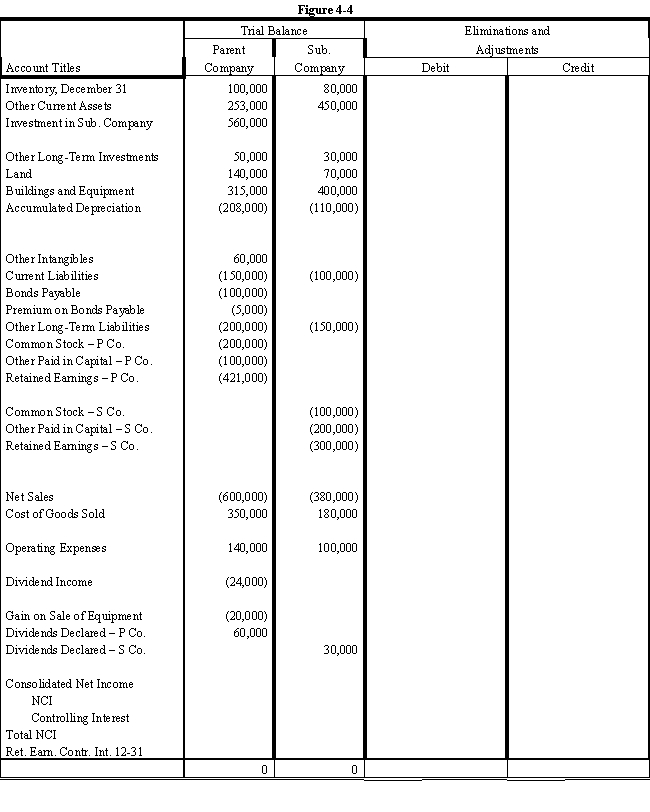

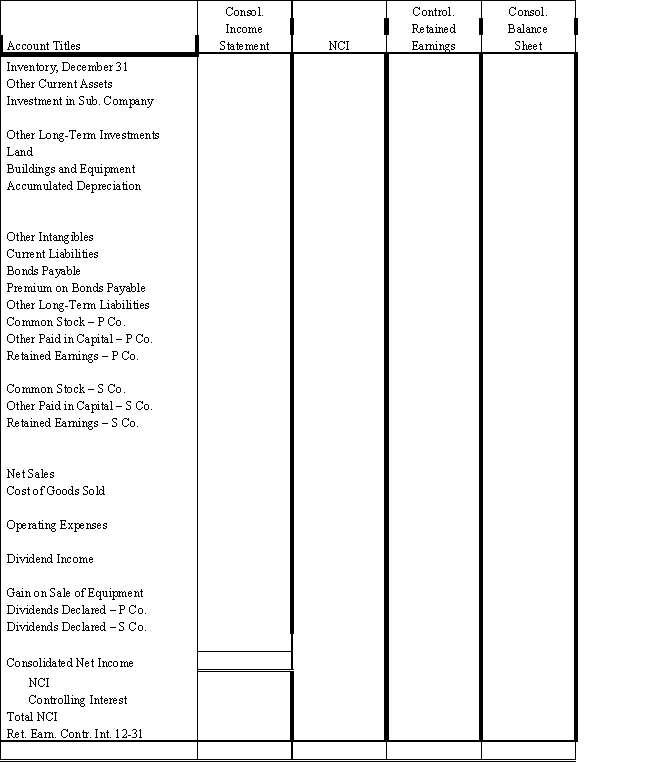

On January 1, 2016, Parent Company acquired 80% of the common stock of Subsidiary Company for $560,000.On this date Subsidiary had total owners' equity of $540,000, including retained earnings of $240,000.During 2016, Subsidiary had net income of $60,000 and paid no dividends.

?

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

?

During 2016 and 2017, Parent has appropriately accounted for its investment in Subsidiary using the cost method.

?

On January 1, 2017, Parent held merchandise acquired from Subsidiary for $10,000.During 2017, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 2017.Subsidiary's usual gross profit on affiliated sales is 40%.

?

On December 31, 2017, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

?

On January 1, 2017, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000.The sales price was $40,000.Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

?

Required:

?

Complete the Figure 4-4 worksheet for consolidated financial statements for the year ended December 31, 2017.

?

?

?

?

Correct Answer:

Verified

Answer 4-4.

?

?

?

?

Eliminations and A...

Eliminations and A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: On January 1, 2016, Parent Company acquired

Q25: On January 1, 2016 Bullock, Inc.sells land

Q26: Stroud Corporation is an 80%-owned subsidiary of

Q27: Which of the following intercompany transactions would

Q28: This year, Rose Company acquired all

Q30: On January 1, 2016, Prange Company acquired

Q31: On 1/1/16 Peck sells a machine with

Q32: Account balances are as of December 31,

Q33: Phelps Co.uses the sophisticated equity method

Q34: On January 1, 2016, Pinto Company