Essay

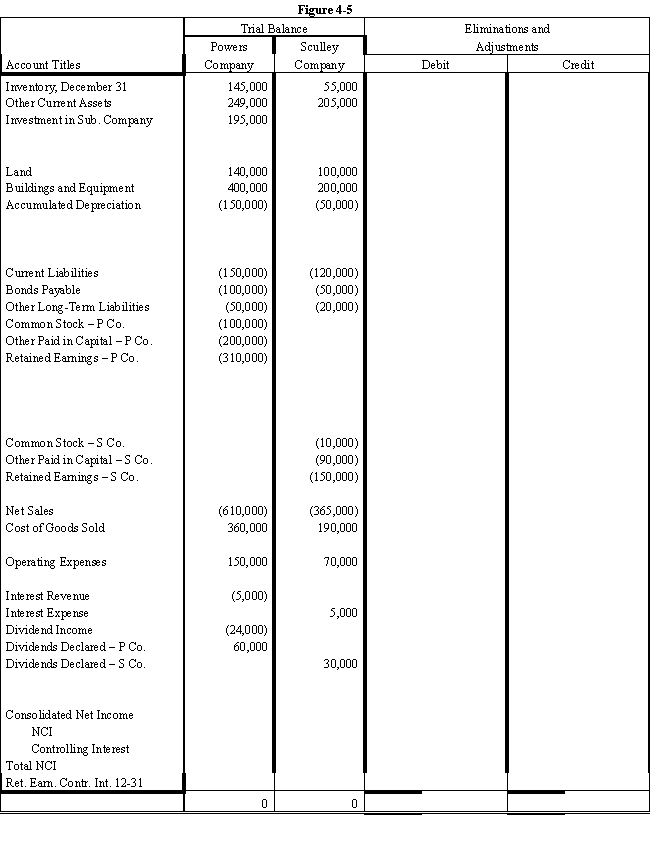

On January 1, 2016, Powers Company acquired 80% of the common stock of Sculley Company for $195,000.On this date Sculley had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earnings of $10,000, $90,000, and $100,000 respectively).

?

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents.FIFO is used for inventories.The equipment has a remaining life of five years and straight-line depreciation is used.The excess to the patents is to be amortized over 20 years.

?

On July 1, 2017 Sculley borrowed $100,000 from Powers with a 10% 1-year note; interest is due at maturity.

?

On January 1, 2017, Powers held merchandise acquired from Sculley for $10,000.During 2017, Sculley sold merchandise to Powers for $50,000, $20,000 of which is still held by Powers on December 31, 2017.Sculley's usual gross profit on affiliated sales is 50%.

?

On December 31, 2016, Powers sold equipment to Sculley at a gain of $10,000.During 2017, the equipment was used by Sculley.Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

?

Both companies have a calendar-year fiscal year.

?

Assume that during 2016 and 2017, Powers has appropriately accounted for its investment in Sculley using the cost method.

?

Required:

?

a.Using the information above or on the Figure 4-5 worksheet, prepare a determination and distribution of excess schedule.?

?

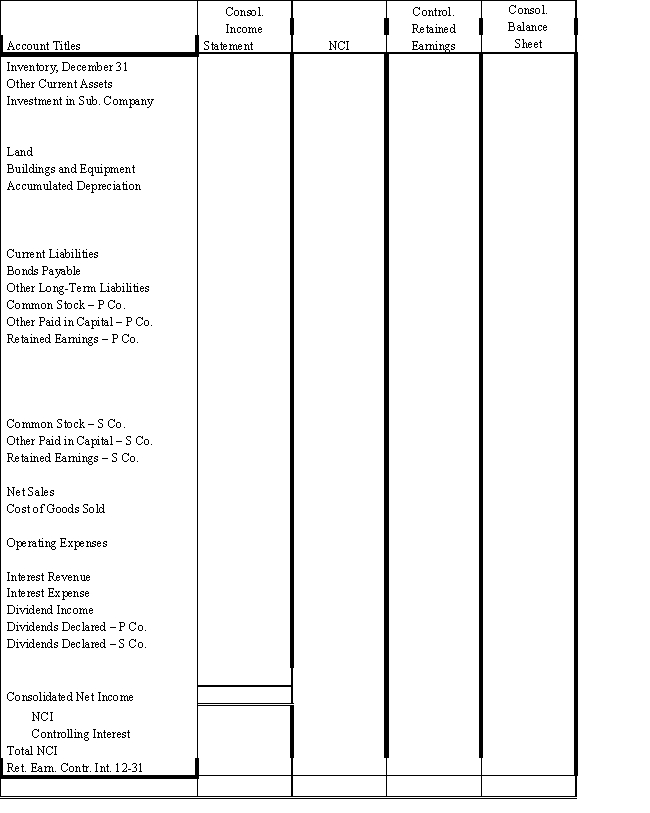

b.Complete the Figure 4-5 worksheet for consolidated financial statements for the year ended December 31, 2017.?

?

?

?

?

?

Correct Answer:

Verified

a.

?

?

?

?

?

?

Eliminations and Adjus...

Eliminations and Adjus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: On January 1, 2016, Prange Company acquired

Q7: Power Company owns a 70% controlling

Q8: Stroud Corporation is an 80%-owned subsidiary of

Q9: Sally Corporation, an 80%-owned subsidiary of Reynolds

Q10: Selected information from the separate and

Q12: Schiff Company owns 100% of the outstanding

Q13: Williard Corporation regularly sells inventory items to

Q14: Phelps Co.uses the sophisticated equity method

Q15: The following accounts were noted in reviewing

Q16: Cattle Company sold inventory with a cost