Essay

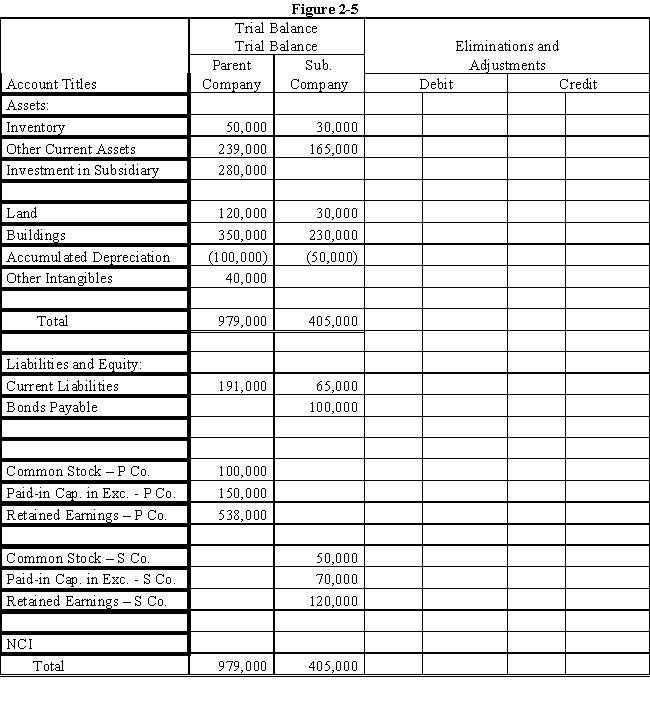

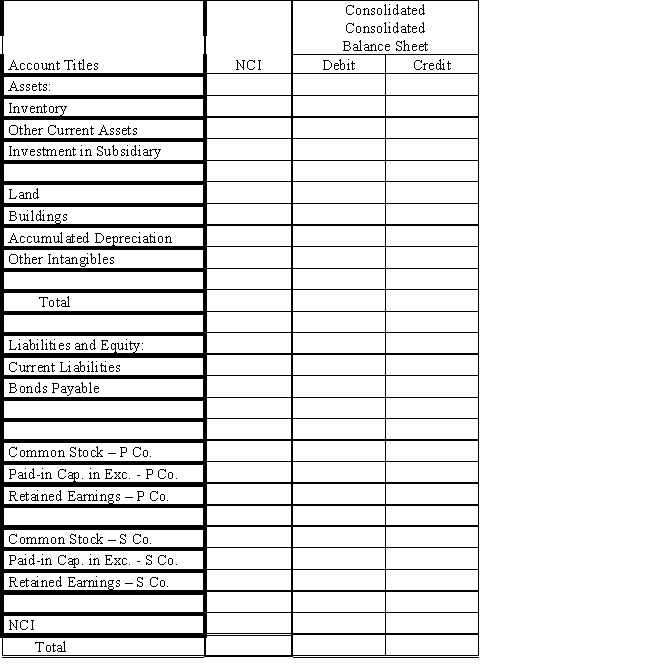

On January 1, 2016, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000.On this date, Subsidiary had total owners' equity of $240,000.

?

On January 1, 2016, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment.The fair value of land is $50,000.The fair value of building and equipment is $200,000.The book value of the land is $30,000.The book value of the building and equipment is $180,000.

?

Required:

?

a.Using the information above and on the separate worksheet, complete a value analysis schedule

?

?

b.Complete schedule for determination and distribution of the excess of cost over book value.?

?

c.Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 2016.?

?

?

?

Correct Answer:

Verified

a. Value analysis schedule:

?

b. Deter...

b. Deter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Consolidation might not be appropriate even when

Q17: Consolidated financial statements are appropriate even without

Q18: Pinehollow acquired 70% of the outstanding

Q19: Fortuna Company issued 70,000 shares of $1

Q20: Pagach Company purchased 100% of the

Q22: Consolidated financial statements are designed to provide:<br>A)informative

Q23: Exercise<br>Assume that Organic Food, Inc.issued 10,000 shares

Q24: Pesto Company paid $8 per share to

Q25: A parent company purchases an 80% interest

Q26: When there is a consolidation with a