Multiple Choice

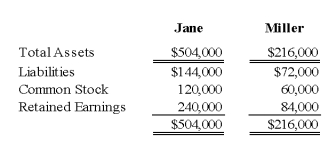

On January 3, 20X9, Jane Company acquired 75 percent of Miller Company's outstanding common stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Miller Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 20X9, are as follows:

-Based on the preceding information,what amount should be reported as noncontrolling interest in net assets in Jane Company's December 31,20X9,consolidated balance sheet?

A) $90,000

B) $54,000

C) $36,000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q14: In which of the following cases would

Q24: On January 1,20X8,Potter Corporation acquired 90 percent

Q26: On January 1,20X8,Potter Corporation acquired 90 percent

Q29: On January 1,20X9,Gold Rush Company acquires 80

Q31: Small-Town Retail owns 70 percent of Supplier

Q32: Under ASC 805,consolidation follows largely which theory

Q35: Company Pea owns 90 percent of Company

Q35: All of the following statements accurately describe

Q37: Small-Town Retail owns 70 percent of Supplier

Q38: On December 31,20X9,Rudd Company acquired 80 percent