Multiple Choice

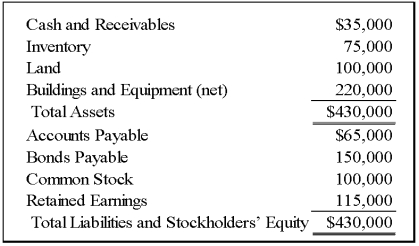

On December 31, 20X9, Add-On Company acquired 100 percent of Venus Corporation's common stock for $300,000. Balance sheet information Venus just prior to the acquisition is given here:

At the date of the business combination, Venus's net assets and liabilities approximated fair value except for inventory, which had a fair value of $60,000, land which had a fair value of $125,000, and buildings and equipment (net) , which had a fair value of $250,000.

-Based on the information provided,what amount will be included as investment in Venus Corporation in the consolidated balance sheet immediately following the acquisition?

A) $0

B) $395,000

C) $255,000

D) $300,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pace Corporation acquired 100 percent of Spin

Q10: On December 31,20X1,Pine Corporation acquired 100 percent

Q11: Pace Corporation acquired 100 percent of Spin

Q24: On July 1,20X9,Playa Corporation paid $340,000 for

Q26: Paccu Corporation acquired 100 percent of Sallee

Q36: Pail,Inc.holds 100 percent of the common stock

Q39: Paccu Corporation acquired 100 percent of Sallee

Q44: Pace Corporation acquired 100 percent of Spin

Q47: On December 31,20X9,Pluto Company acquired 100 percent

Q55: On July 1,20X9,Playa Corporation paid $340,000 for