Multiple Choice

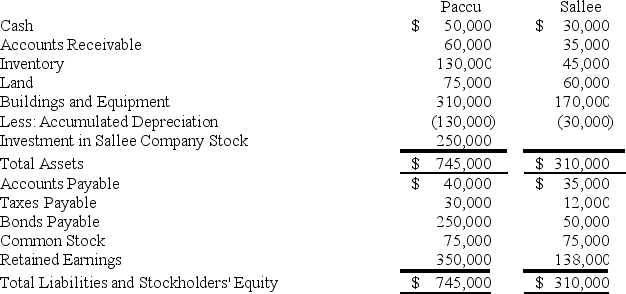

Paccu Corporation acquired 100 percent of Sallee Company's common stock on January 1,20X7.Balance sheet data for the two companies immediately following the acquisition follow:

At the date of the business combination,the book values of Sallee's assets and liabilities approximated fair value except for inventory,which had a fair value of $55,000,and land,which had a fair value of $65,000.The fair value of land for Paccu Corporation was estimated at $90,000 immediately prior to the acquisition.

At the date of the business combination,the book values of Sallee's assets and liabilities approximated fair value except for inventory,which had a fair value of $55,000,and land,which had a fair value of $65,000.The fair value of land for Paccu Corporation was estimated at $90,000 immediately prior to the acquisition.

-Based on the preceding information,what is the differential associated with the acquisition?

A) $15,000

B) $20,000

C) $22,000

D) $37,000

Correct Answer:

Verified

Correct Answer:

Verified

Q34: On January 1,20X8,Patriot Company acquired 100 percent

Q35: Paccu Corporation acquired 100 percent of Sallee

Q36: Pail,Inc.holds 100 percent of the common stock

Q37: Plant Company acquired all of Sprout Corporation's

Q38: Tanner Company,a subsidiary acquired for cash,owned equipment

Q40: On December 31,20X1,Pine Corporation acquired 100 percent

Q41: On January 1,20X9,Paradox Company acquired all of

Q42: Pace Corporation acquired 100 percent of Spin

Q43: Pail,Inc.holds 100 percent of the common stock

Q44: Pace Corporation acquired 100 percent of Spin