Multiple Choice

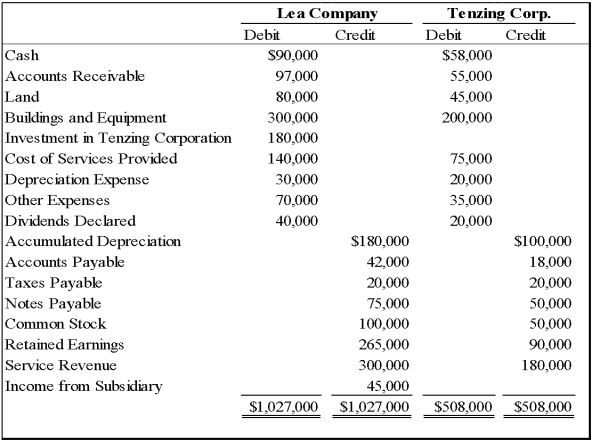

Lea Company acquired all of Tenzing Corporation's stock on January 1, 20X6 for $150,000 cash. On December 31, 20X8, the trial balances of the two companies were as follows:

Tenzing Corporation reported retained earnings of $75,000 at the date of acquisition. The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of five years from the date of acquisition. At December 31, 20X8, Tenzing owed Lea $4,000 for services provided.

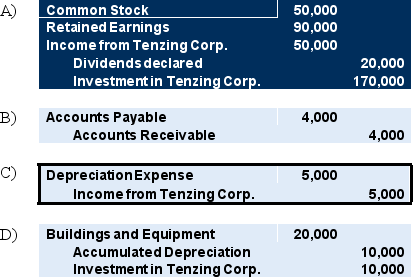

-Based on the preceding information,all of the following are consolidating entries required on December 31,20X8,to prepare consolidated financial statements,except:

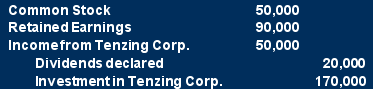

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which term refers to the practice of

Q20: Paccu Corporation acquired 100 percent of Sallee

Q32: Paris,Inc.holds 100 percent of the common stock

Q34: On January 1,20X8,Patriot Company acquired 100 percent

Q55: The Greenpath Corporation's (Greenpath)balance sheet shows assets

Q56: Paco Company acquired 100 percent of the

Q60: Park Co.uses the equity method to account

Q61: Paccu Corporation acquired 100 percent of Sallee

Q62: On January 1, 20X8, Chariot Company acquired

Q64: An investor uses the equity method to