Multiple Choice

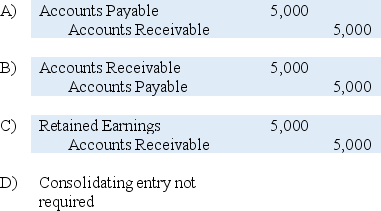

On January 1,20X8,Blake Company acquired all of Frost Corporation's voting shares for $280,000 cash.On December 31,20X9,Frost owed Blake $5,000 for services provided during the year.When consolidated financial statements are prepared for 20X9,which entry is needed to eliminate intercompany receivables and payables in the consolidation worksheet?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q10: On December 31,20X1,Pine Corporation acquired 100 percent

Q16: Silver Corporation acquired 100 percent of Bronze

Q18: Which of the following observations is NOT

Q22: Pace Corporation acquired 100 percent of Spin

Q25: On December 31,20X1,Pine Corporation acquired 100 percent

Q31: On January 1,20X9,Paradox Company acquired all of

Q37: Plant Company acquired all of Sprout Corporation's

Q40: On December 31,20X1,Pine Corporation acquired 100 percent

Q48: On October 1,20X3,Pole Corporation paid $450,000 for

Q57: On December 31,20X9,Pluto Company acquired 100 percent