Multiple Choice

The following information applies to Questions 39-40

On January 1, 20X8, Ramon Corporation acquired 75 percent of Tester Company's voting common stock for $300,000. At the time of the combination, Tester reported common stock outstanding of $200,000 and retained earnings of $150,000, and the fair value of the noncontrolling interest was $100,000. The book value of Tester's net assets approximated market value except for patents that had a market value of $50,000 more than their book value. The patents had a remaining economic life of ten years at the date of the business combination. Tester reported net income of $40,000 and paid dividends of $10,000 during 20X8.

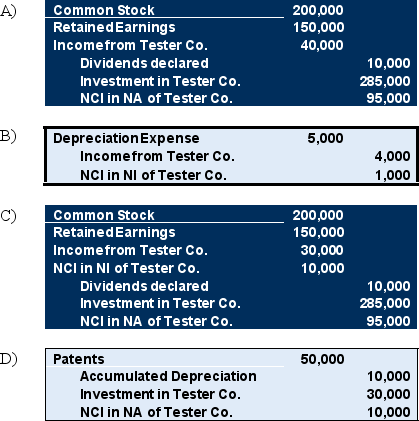

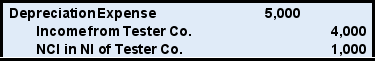

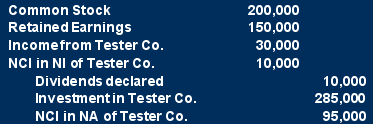

-Based on the preceding information,which of the following is an consolidating entry needed to prepare a full set of consolidated financial statements at December 31,20X8:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1,20X9,Pirate Corporation acquired 80 percent

Q13: On January 1,20X9,Pirate Corporation acquired 80 percent

Q27: On January 1,20X9,Pirate Corporation acquired 80 percent

Q42: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q46: On December 31,20X5,Paris Corporation acquired 60 percent

Q49: Which of the following stockholders equity accounts

Q50: Based on the preceding information,what amount of

Q52: The following information applies to Questions 29-31<br>On

Q55: On January 1,20X8,Vector Company acquired 80 percent

Q58: When a parent owns less than 100%