Multiple Choice

The following information applies to Questions 41-45

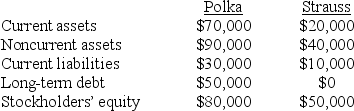

On January 1, 20X6, Polka Co. (Polka) and Strauss Co. (Strauss) had condensed balance sheets as follows:

On January 2, 20X6, Polka borrowed $90,000 and used the proceeds to acquire 90% of the outstanding common shares of Strauss. This debt is payable in ten equal annual principal and accrued interest payments beginning December 30, 20X6. On the acquisition date, the fair value of Strauss was $100,000, and the excess cost of the investment over Strauss's carrying amount of acquired net assets should be allocated 60% to inventory and 40% to goodwill.

On January 2, 20X6, Polka borrowed $90,000 and used the proceeds to acquire 90% of the outstanding common shares of Strauss. This debt is payable in ten equal annual principal and accrued interest payments beginning December 30, 20X6. On the acquisition date, the fair value of Strauss was $100,000, and the excess cost of the investment over Strauss's carrying amount of acquired net assets should be allocated 60% to inventory and 40% to goodwill.

-Stockholders' equity on the January 2,20X6,consolidated balance sheet should be:

A) $85,000

B) $80,000

C) $90,000

D) $130,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Based on the preceding information,what amount of

Q9: The following information applies to Questions 21-26<br>On

Q12: On January 1,20X8,Package Company acquired 80 percent

Q13: The following information applies to Questions 29-31<br>On

Q14: Pink Inc.sells half of its 70% interest

Q15: The following information applies to Questions 35-26<br>On

Q16: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q16: On December 31,20X8,Defoe Corporation acquired 80 percent

Q25: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q35: On January 1,20X6,Pumpkin Corporation acquired 70 percent