Multiple Choice

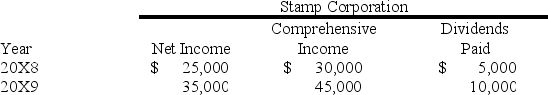

On January 1,20X8,Package Company acquired 80 percent of Stamp Company's common stock for $280,000 cash.At that date,Stamp reported common stock outstanding of $200,000 and retained earnings of $100,000,and the fair value of the noncontrolling interest was $70,000.The book values and fair values of Stamp's assets and liabilities were equal,except for other intangible assets which had a fair value $50,000 greater than book value and an 8-year remaining life.Stamp reported the following data for 20X8 and 20X9:

Package reported net income of $100,000 and paid dividends of $30,000 for both the years.

Package reported net income of $100,000 and paid dividends of $30,000 for both the years.

-Based on the preceding information,what is the amount of comprehensive income attributable to the controlling interest for 20X8?

A) $123,750

B) $118,750

C) $119,000

D) $104,000

Correct Answer:

Verified

Correct Answer:

Verified

Q38: On January 1,20X9,Pirate Corporation acquired 80 percent

Q39: On December 31,20X8,Pancake Company acquired controlling ownership

Q40: When a parent owns less than 100%

Q41: Postage Corporation acquired 75 percent of Stamp

Q42: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q44: Scissor Corporation holds assets with a fair

Q45: On January 1,20X6,Plus Corporation acquired 90 percent

Q46: On December 31,20X5,Paris Corporation acquired 60 percent

Q47: On December 31,20X5,Paris Corporation acquired 60 percent

Q48: On December 31,20X8,Pancake Company acquired controlling ownership