Multiple Choice

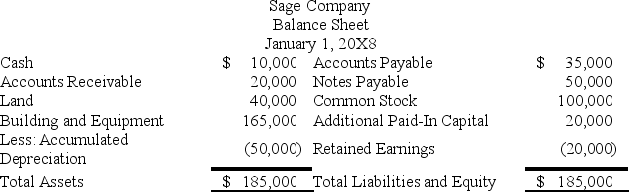

On January 1,20X8,Parsley Corporation acquired 75 percent of Sage Company's voting common stock for $90,000 cash.At that date,the fair value of the noncontrolling interest was $30,000.Sage's balance sheet at the date of acquisition contained the following balances:

At the date of acquisition,the reported book values of Sage's assets and liabilities approximated fair value.Consolidating entries are being made to prepare a consolidated balance sheet immediately following the business combination.

At the date of acquisition,the reported book values of Sage's assets and liabilities approximated fair value.Consolidating entries are being made to prepare a consolidated balance sheet immediately following the business combination.

-Based on the preceding information,in the entry to eliminate the investment balance,

A) retained earnings will be credited for $20,000.

B) additional paid-in-capital will be credited for $20,000.

C) retained earnings will be credited for $10,000.

D) noncontrolling interest will be debited for 30,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: On December 31,20X8,Peak Corporation acquired 80 percent

Q20: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q21: On January 1,20X8,Polo Corporation acquired 75 percent

Q22: Postage Corporation acquired 75 percent of Stamp

Q23: Postage Corporation acquired 75 percent of Stamp

Q25: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q26: On January 1,20X6,Plus Corporation acquired 90 percent

Q27: On January 1,20X9,Pirate Corporation acquired 80 percent

Q28: On December 31,20X8,Peak Corporation acquired 80 percent

Q29: On December 31,20X8,Pancake Company acquired controlling ownership