Multiple Choice

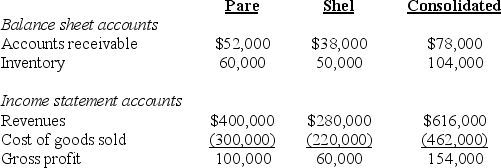

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

-At December 31,20X5,what was the amount of Shel's payable to Pare for intercompany sales?

A) $12,000

B) $6,000

C) $58,000

D) $64,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Pluto Company owns 100 percent of the

Q29: Pisa Company acquired 75 percent of Siena

Q30: On January 1,20X7,Jones Company acquired 90 percent

Q33: Pink Corporation owns 80 percent of Sink

Q34: Clark Co.had the following transactions with affiliated

Q35: Pisa Company acquired 75 percent of Siena

Q35: Parent Corporation owns 90 percent of Subsidiary

Q46: Parent Corporation owns 90 percent of Subsidiary

Q56: Pink Corporation owns 80 percent of Sink

Q63: Potter Company acquired 75 percent ownership of