Multiple Choice

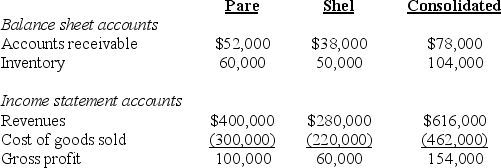

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

-In Pare's consolidating worksheet,what amount of unrealized intercompany profit was eliminated?

A) $12,000

B) $6,000

C) $58,000

D) $64,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The consolidation treatment of profits on inventory

Q8: Parent Corporation owns 90 percent of Subsidiary

Q14: Pluto Company owns 100 percent of the

Q24: Perth Corporation owns 90 percent of Sydney

Q35: Parent Corporation owns 90 percent of Subsidiary

Q39: Pink Corporation owns 80 percent of Sink

Q40: Colton Company acquired 80 percent ownership of

Q43: ABC Corporation owns 75 percent of XYZ

Q44: Senior Inc.owns 85 percent of Junior Inc.During

Q60: Pepper Corporation owns 75 percent of Salt