Multiple Choice

Which worksheet consolidation entry will be made on December 31,20X3,if Allen Corporation had initially purchased the land for $60,000 and then sold it to Hilldale on August 7,20X2,for $35,000?

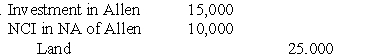

A)

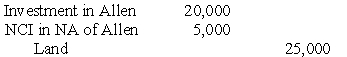

B)

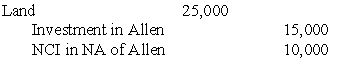

C)

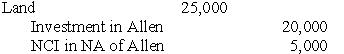

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A parent sold land to its partially

Q14: Plesco Corporation acquired 80 percent of Slesco

Q18: On January 1,20X7,Server Company purchased a machine

Q32: Paper Corporation owns 75 percent of Scissor

Q33: Pint Corporation holds 70 percent of Size

Q35: Parent Corporation purchased land from S1 Corporation

Q40: Postage Corporation receives management consulting services from

Q44: Plesco Corporation acquired 80 percent of Slesco

Q46: Parent Corporation purchased land from S1 Corporation

Q47: Pluto Corporation owns 70 percent of Saturn