Essay

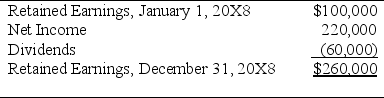

For the first quarter of 20X8,Vinyl Corporation reported sales of $150,000 and operating expenses of $100,000,and paid dividends of $20,000.Vinyl Company operates on a calendar-year basis.On April 1,20X8,Signature Corporation acquired 80 percent of Vinyl's common stock for $320,000.At that date,the fair value of the noncontrolling interest was $80,000,and Vinyl had 20,000 shares of $5 par common stock outstanding,originally issued at $12 per share.The differential is related to goodwill.On December 31,20X8,the management of Signature Corporation reviewed the amount attributed to goodwill as a result of its acquisition of Vinyl common stock and concluded that goodwill was not impaired.Vinyl's retained earnings statement for the full year 20X8 appears as follows:

Signature uses the fully adjusted equity method in accounting for this investment:

Required:

1)Prepare all entries that Signature would have recorded in accounting for its investment in Vinyl during 20X8.

2)Present all consolidating entries needed in a worksheet to prepare a complete set of consolidated financial statements for the year 20X8.

Problem 56 (continued):

Correct Answer:

Verified

1)

2)

2)

...

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The following information comes from Torveson Company's

Q10: Pain Corporation holds 90 percent of Soothing

Q15: Plexis Corporation holds 70 percent of Solar

Q29: Plush Corporation holds 80 percent of Scratch

Q35: Company A holds 70 percent of the

Q37: Locus Corporation acquired 80 percent ownership of

Q40: Pure Life Corporation has just finished preparing

Q42: Catalyst Corporation acquired 90 percent of Trigger

Q43: Company A owns 85 percent of Company

Q51: Pure Life Corporation has just finished preparing