Essay

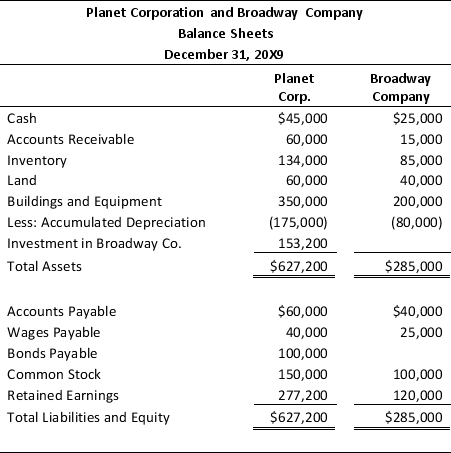

On December 31,20X7,Planet Corporation acquired 80 percent of Broadway Company's stock,at underlying book value.At that date,the fair value of the noncontrolling interest was equal to 20 percent of the book value of Broadway Company.The two companies' balance sheets on December 31,20X9,are as follows:

On December 31,20X9,Planet holds inventory purchased from Broadway for $40,000.Broadway's cost of producing the merchandise was $25,000.Broadway's ending inventory also contains $30,000 of purchases from Planet that had cost it $20,000 to produce.

On December 30,20X9,Broadway sold equipment to Planet for $40,000.Broadway had purchased the equipment for $60,000 several years earlier.At the time of sale to Planet,the equipment had a book value of $20,000.The two companies file separate tax returns and are subject to a 40 percent tax rate.Planet does not record tax expense on its share of Broadway's undistributed earnings.

Required:

1)Prepare the consolidating entries necessary to complete a consolidated balance sheet worksheet as of December 31,20X9.

2)Complete a consolidated balance sheet worksheet as of December 31,20X9.

Problem 57 (continued):

Correct Answer:

Verified

1)

Problem 57 ...

Problem 57 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q10: Company A holds 70 percent of the

Q13: Pure Life Corporation has just finished preparing

Q13: Which of the following observations concerning the

Q14: On January 1, 20X8, Gulfstream Corporation acquired

Q14: Polar Corporation's consolidated cash flow statement for

Q21: Polar Corporation's consolidated cash flow statement for

Q23: Pappas Company owns 85 percent of Sunny

Q28: Power Corporation's controller has just finished preparing

Q41: The following information comes from Torveson Company's