Multiple Choice

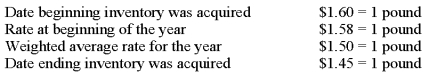

The British subsidiary of a U.S.company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31.The beginning inventory was 10,000 pounds,and the ending inventory was 15,000 pounds.Spot rates for various dates are as follows:  Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

A) $108,750.

B) $112,500.

C) $114,300.

D) $125,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: On January 2, 20X8, Johnson Company acquired

Q7: Seattle,Inc.owns an 80 percent interest in a

Q9: Prepare a schedule providing a proof of

Q10: Certain balance sheet accounts of a foreign

Q12: Barcode Corporation acquired 70% of the common

Q12: All of the following describe the International

Q13: All of the following are benefits the

Q14: On January 1,2008,Pace Company acquired all of

Q33: On October 15,20X1,Planet Company sold inventory to

Q37: Park Co.'s wholly-owned subsidiary,Schnell Corp. ,maintains its