Multiple Choice

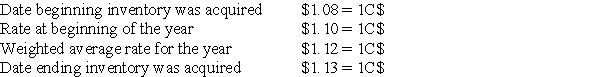

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the Canadian dollar is the functional currency of the Canadian subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is

A) $50,000

B) $55,300

C) $56,000

D) $56,500

Correct Answer:

Verified

Correct Answer:

Verified

Q28: If the U.S.dollar is the currency in

Q30: Michigan-based Leo Corporation acquired 100 percent of

Q53: On January 1,20X8,Pullman Corporation acquired 75 percent

Q65: Mercury Company is a subsidiary of Neptune

Q66: Which of the following describes a situation

Q67: The functional currency of Nash,Inc.'s subsidiary is

Q68: Which combination of accounts and exchange rates

Q69: Mazeppa,Inc.is a multinational entity with its head

Q73: On January 2, 20X8, Johnson Company acquired

Q75: On January 2, 20X8, Johnson Company acquired