Multiple Choice

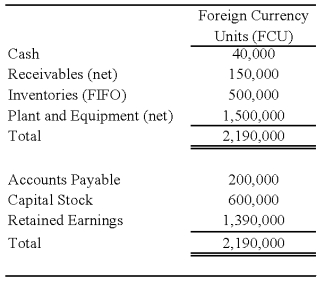

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

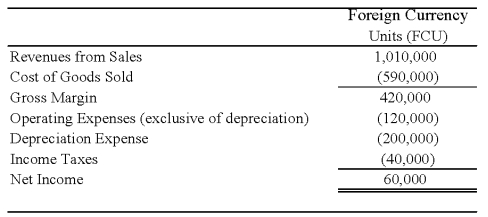

Perth's income statement for 20X8 is as follows:

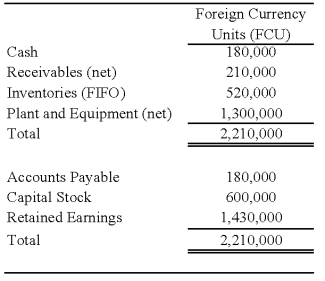

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

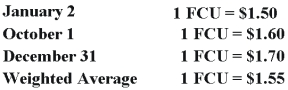

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2,20X8.Round your answer to the nearest dollar.

A) $11,500

B) $11,884

C) $7,667

D) $9,394

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Under the temporal method,which of the following

Q31: On January 1,20X8,Pullman Corporation acquired 75 percent

Q52: South Company is a subsidiary of Pole

Q55: On January 2, 20X8, Johnson Company acquired

Q56: Infinity Corporation acquired 80 percent of the

Q59: On January 2, 20X8, Johnson Company acquired

Q59: Michigan-based Leo Corporation acquired 100 percent of

Q61: On January 1,2008,Pace Company acquired all of

Q64: If the functional currency is the local

Q65: Mercury Company is a subsidiary of Neptune