Multiple Choice

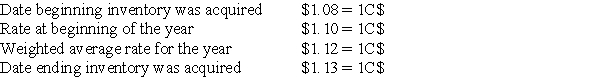

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the U.S.dollar is the functional currency of the Canadian subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is

A) $50,000

B) $55,300

C) $56,000

D) $56,500

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The British subsidiary of a U.S.company reported

Q34: On September 30, 20X8, Wilfred Company sold

Q35: Barcode Corporation acquired 70% of the common

Q36: The assets listed below of a foreign

Q37: In cases of operations located in highly

Q39: If the restatement method for a foreign

Q41: Which combination of accounts and exchange rates

Q42: On September 30, 20X8, Wilfred Company sold

Q43: On September 30, 20X8, Wilfred Company sold

Q56: All of the following stockholders' equity accounts