Multiple Choice

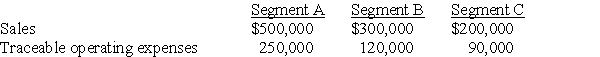

Tuttle Company discloses supplementary operating segment information for its three reportable segments.Data for 20X3 are available as follows:

Allocable costs for the year were $54,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X3 operating profit for Segment A was

A) $196,000

B) $223,000

C) $225,000

D) $250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Reno Corporation disposed of one of its

Q27: Wakefield Company uses a perpetual inventory system.In

Q33: An analysis of Abbey Company's operating segments

Q47: The income tax expense applicable to the

Q52: Derby Company pays its executives a bonus

Q53: Stone Company reported $100,000,000 of revenues on

Q55: Main Manufacturing Corporation reported consolidated revenues of

Q57: ASC 280 uses a(n)_ approach to the

Q60: Reportable segments are not required to disclose

Q62: Which of the following characteristics would render