Multiple Choice

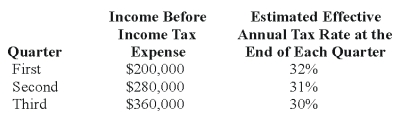

Toledo Imports,a calendar-year corporation,had the following income before tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:  Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

A) $250,800 and $103,200.

B) $252,000 and $108,000.

C) $252,000 and $103,200.

D) $250,800 and $108,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Frahm Company incurred a first quarter operating

Q15: The management approach to the definition of

Q30: Davis Company uses LIFO for all of

Q34: Interim income statements are required for Smith

Q41: ASC 280 requires certain disclosures about major

Q43: The key to reporting accounting information by

Q44: Dragon Company has two reportable segments,A and

Q45: The information below is for the second

Q49: Samuel Corporation foresees a downturn in its

Q59: Wakefield Company uses a perpetual inventory system.In