Multiple Choice

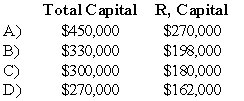

RD formed a partnership on February 10,20X9.R contributed cash of $150,000,while D contributed inventory with a fair value of $120,000.Due to R's expertise in selling,D agreed that R should have 60 percent of the total capital of the partnership.R and D agreed to recognize goodwill.What is the total capital of the RD partnership and the capital balance of R after the goodwill is recognized?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In the JK partnership, Jacob's capital is

Q9: A limited liability company (LLC):<br>I.is governed by

Q12: In the JK partnership,Jacob's capital is $140,000,and

Q20: When a new partner is admitted into

Q21: In the AD partnership,Allen's capital is $140,000

Q34: Which of the following accounts could be

Q48: A partner's tax basis in a partnership

Q56: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q67: In the JK partnership,Jacob's capital is $140,000,and

Q68: When a new partner is admitted into