Multiple Choice

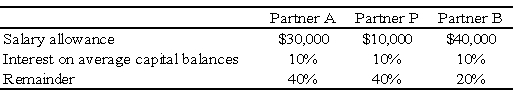

The APB partnership agreement specifies that partnership net income be allocated as follows:

Average capital balances for the current year were $50,000 for A, $30,000 for P, and $20,000 for B.

-Refer to the information given.Assuming a current year net income of $150,000,what amount should be allocated to each partner?

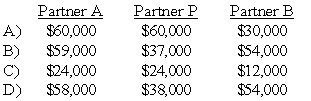

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The terms of a partnership agreement provide

Q24: In the AD partnership,Allen's capital is $140,000

Q29: Which of the following accounts could be

Q34: James Dixon,a partner in an accounting firm,decided

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q36: Griffin and Rhodes formed a partnership on

Q37: Fox,Greg,and Howe are partners with average capital

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q57: When a new partner is admitted into

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the