Multiple Choice

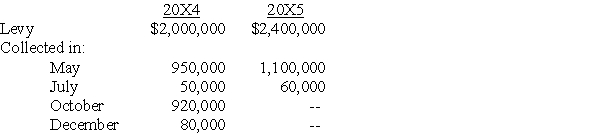

Pine City's year end is June 30.Pine levies property taxes in January of each year for the calendar year.One-half of the levy is due in May and one-half is due in October.Property tax revenue is budgeted for the period in which payment is due.The following information pertains to Pine's property taxes for the period from July 1,20X4,to June 30,20X5:

Calendar Year

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5.What amount should Pine recognize for property tax revenue for the year ended June 30,20X5?

A) $2,160,000

B) $2,200,000

C) $2,360,000

D) $2,400,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following funds are classified

Q11: The general fund of Wold Township ordered

Q14: The general fund of Sun City was

Q27: The general fund of Gillette levied property

Q39: The general fund of Athens ordered computer

Q49: When an internal service fund (ISF)enters into

Q51: Gotham City acquires $25,000 of inventory on

Q52: What amount should be reported as expenditures

Q55: Blue Ridge Township uses the consumption method

Q60: The general fund of Battle Creek budgeted