Short Answer

Goshen City acquires $36,000 of inventory on November 1, 20X5, having held no inventory previously. On December 31, 20X5, the end of Goshen City's fiscal year, a physical count shows $7,000 still in stock. During 20X6, $5,000 of this inventory is used, resulting in a $2,000 remaining balance of supplies on December 31, 20X6.

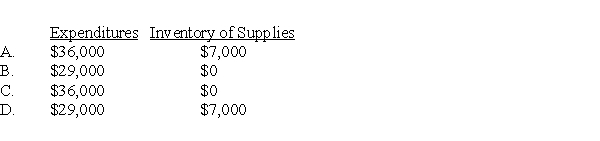

-Based on the preceding information,which of the following would be the correct account balances for 20X5 if Goshen City used the purchase method of accounting for inventories?

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following items should not

Q9: At the end of the fiscal year,uncollected

Q16: Which of the following accounts are debited

Q17: The following information pertains to property taxes

Q18: Which accounts described below would have non-zero

Q20: In accounting for governmental funds,which of the

Q22: The Board of Commissioners of Vane City

Q23: Which of the following observations concerning encumbrances

Q24: The following information was obtained from the

Q44: All of the following are elements of