Essay

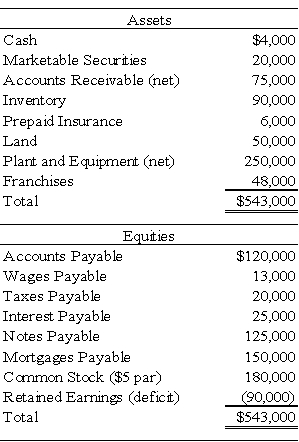

Wilbur Corporation is to be liquidated under Chapter 7 of the Bankruptcy Code.The balance sheet on December 31,20X8,is as follows:

The following additional information is available:

1.Marketable securities consist of 2,000 shares of Bristol Inc.common stock.The market value per share of the stock is $8.The stock was pledged against a $20,000,8 percent note payable that has accrued interest of $800.

2.Accounts receivable of $40,000 are collateral for a $35,000,10 percent note payable that has accrued interest of $3,500.

3.Inventory with a book value of $35,000 and a current value of $32,000 is pledged against accounts payable of $60,000.The appraised value of the remainder of the inventory is $50,000.

4.Only $1,000 will be recovered from prepaid insurance.

5.Land is appraised at $65,000 and plant and equipment at $160,000.

6.It is estimated that the franchises can be sold for $15,000.

7.All the wages payable qualify for priority.

8.The mortgages are on the land and on a building with a book value of $110,000 and an appraised value of $100,000.The accrued interest on the mortgages is $7,500.

9.Estimated legal and accounting fees for the liquidation are $10,000.

Required

a.Prepare a statement of affairs as of December 31,20X8.

b.Compute the estimated percentage settlement to unsecured creditors.

Problem 43 (continued):

Correct Answer:

Verified

Problem ...

Problem ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Under which nonjudicial action do creditors agree

Q4: "Preference payments" made by the debtor to

Q6: Under the Bankruptcy Code,an insolvent corporation may

Q12: A reorganization value in excess of amounts

Q21: Chapter 11 of the Bankruptcy Code provides

Q22: What is defined as a condition in

Q25: The Bankruptcy Reform Act contains chapters which

Q28: Typically,the plan of reorganization must be approved

Q41: Orville Company recently petitioned for bankruptcy and

Q45: A "debtor-in-possession" balance sheet is prepared for