Essay

On January 1,20X7,Gild Company acquired 60 percent of the outstanding common stock of Leeds Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Leeds.At the time of purchase,Leeds had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,20X7,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,20X4,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

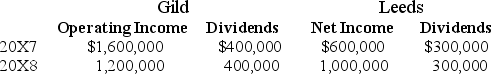

Income and dividends for Gild and Leeds for 20X7 and 20X8 are as follows:

Assume Gild accounts for its investment in Leeds stock using the cost method.

Required:

A)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

B)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 40 (continued):

Correct Answer:

Verified

a.

Probl...

Probl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Spice Company issued $200,000 of 10 percent

Q23: Postage,a holder of a $400,000 Stamp Inc.bond,collected

Q33: Saturn Corporation issued $300,000 par value 10-year

Q35: Senior Corporation acquired 80 percent of Junior

Q35: Pancake Corporation owns 85 percent of Syrup

Q36: Hunter Corporation holds 80 percent of the

Q36: Saturn Corporation issued $300,000 par value 10-year

Q37: At the end of the year,a parent

Q40: Culver owns 80 percent of the common

Q45: A subsidiary issues bonds.The parent can then