Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

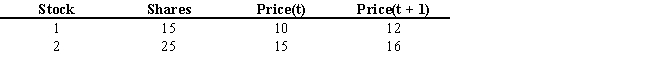

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

-Refer to Exhibit 1.6. Calculate the market weights for stock 1 and 2 based on period t values.

A) 39%for stock 1 and 61% for stock 2

B) 50% for stock 1 and 50% for stock 2

C) 71% for stock 1 and 29% for stock 2

D) 29% for stock 1 and 71% for stock 2

E) 30% for stock 1 and 82% for stock 2

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Two factors that influence the nominal risk-free

Q4: The line that reflects the combination of

Q5: The risk premium is a function of

Q6: Which of the following is least likely

Q7: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q9: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q10: The total risk for a security can

Q11: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q12: What will happen to the security market

Q13: Sources of risk for an investment include<br>A)