Multiple Choice

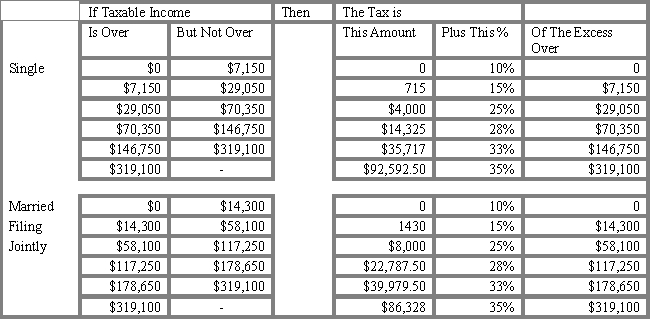

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the tax liability for a single individual with taxable income of $85,000?

A) $23,800

B) $18,427

C) $24,958

D) $16,867

E) $19,650

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: The portfolio mixes of institutional investors around

Q41: In constructing the portfolio, the manager should

Q42: Assume that you invest $750 at the

Q43: Which of the following is NOT a

Q44: Someone in the 15 percent tax bracket

Q46: For an investor with a time horizon

Q47: An individual in the 15 percent tax

Q48: John is 55 years old and has

Q49: The majority of a pension fund's return

Q50: _ must be stated in terms of