Multiple Choice

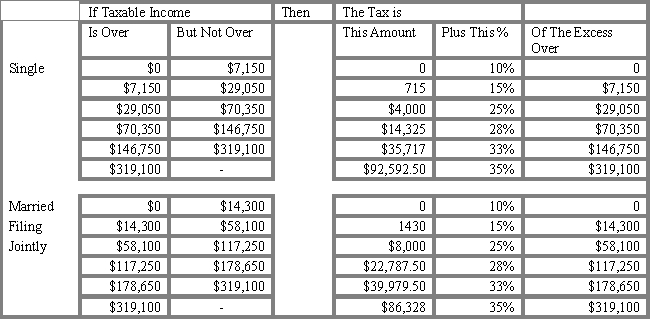

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the average tax for a single individual with taxable income of $85,000?

A) 13.57%

B) 15.68%

C) 21.68%

D) 25.74%

E) 29.55%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q67: Which of the following is NOT considered

Q68: Most art and antiques are _, and

Q69: An individual in the 36 percent tax

Q70: Term life insurance provides both a death

Q71: The asset allocation decision must involve a

Q73: The first step in the investment process

Q74: The spending phase occurs when investors are

Q75: An appropriate investment objective for a typical

Q76: For an investor with a time horizon

Q77: Arts and antiques are inferior inflation hedges